- 100% assured internships

- Placement Assured Program

- 550+ Hiring Partners

- 100% Money Return Policy

- 100% assured internships

- Placement Assured Program

- 500+ Hiring Partners

- 100% Money Return Policy

Certified Financial Analyst Course

World’s Only Placement Guarantee Course With 100% Money Back Policy

If You Do Not Get Placed, the Course Fee Will be Refunded

8 Capstone Projects With:

Upcoming Batch:

Every Sat & Sun - 10:00 AM - 12:00 PM (IST)

Course Highlights

Accredited

LMS Access

Hours Lectures

Certification

Guaranteed Internship

Accredited Certificates

Job Guarantee

Capstone Projects

Mentorship

Support

Guarantee

Exclusive Access

Why Choose IIM SKILLS??

Our Affiliation’s & Accreditation’s

Reservation Closing in Next

Ranked #1 Program By:

![]()

IIM Skills Introduces Domain Specialisation Programme for Sustainable Career Transition.

![]()

IIM Skills Introduces Domain Specialisation Programme for Sustainable Career Transition.

![]()

IIM Skills Introduces Domain Specialisation Programme for Sustainable Career Transition.

Highly Rated Financial Analyst Course

Basic and Advance Excel

Technicals of Financial Modeling

New Age Tools

Ratio & KPI Analysis

Fundamentals of Financial System and Market

Corporate Finance

Accounting Concepts & Financial Statements

Business Valuation

New Age Tools

- 100% assured internships

- Placement Assured Program

- 550+ Hiring Partners

- 100% Money Return Policy

550+ Hiring Partners

- 100% assured internships

- Placement Assured Program

- 550+ Hiring Partners

- 100% Money Return Policy

Tools Covered

- 100% assured internships

- Placement Assured Program

- 550+ Hiring Partners

- 100% Money Return Policy

Course Certification

Certification Include IIM SKILLS Course, Capstone Projects from Bank of America, JP Morgan, New York Jobs CEO Council & BCG and Internships

Course Certification from IIM SKILLS

Capstone Projects Certification

- 100% assured internships

- Placement Assured Program

- 550+ Hiring Partners

- 100% Money Return Policy

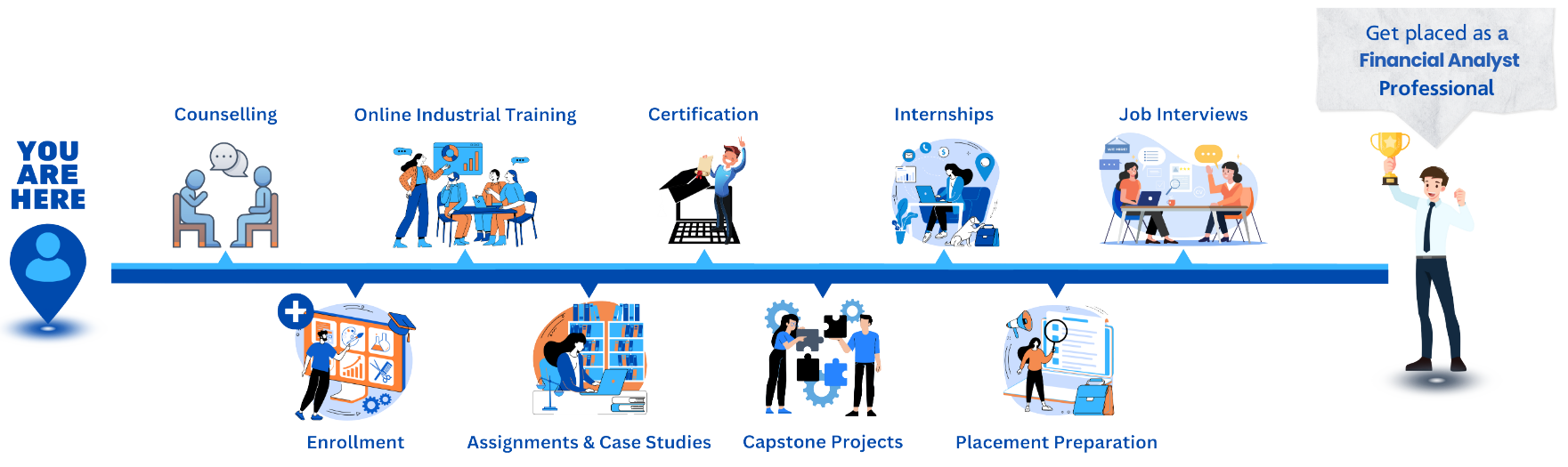

Glimpse of Your Journey With Us

- 100% assured internships

- Placement Assured Program

- 550+ Hiring Partners

- 100% Money Return Policy

Past Placement

- 100% assured internships

- Placement Assured Program

- 550+ Hiring Partners

- 100% Money Return Policy

Frequently Asked Questions

A Financial Analyst Course is a short-term certification program making it perfect for students and professionals looking to enter the finance field shortly. These courses focus on practical skills like financial modeling, budgeting, and data analysis. These courses are also replete with live projects and assignments that help to get an idea of how the financial world works in real life.

The financial analyst courses are also comparatively cost-effective making it relatively accessible to anyone wanting to upskill without burning a hole in their pockets. You can acquire targeted, specific skills that can help you get your foot in the door in the finance sector. It is ideal for entry-level job openings and perfect for professionals who want to learn on the job.

The Chartered Financial Analyst Program is a long-term program that requires you to devote a significant number of years to master the skills required to excel in the finance and corporate sector. The CFA Program comes with recognition and respect that invariably gives a boost to your equity as a finance professional. It enhances your chances of getting the most highly-paid jobs once you complete the course.

Also, it is more expensive than a financial analyst course so you have to judiciously plan and decide on the monetary aspect before enrolling in the course.

To sum it up, If you are someone who is looking for a course that will be in-depth but will get over in a few months go for a financial analyst course. It is also ideal for complete novices and people with little experience in the finance sector. A Certified Financial Analyst Course will also help you with securing a job faster. But for a rigorous and intensive program that will help you master the financial concepts go for the Chartered Financial Analyst Course.

- 100% assured internships

- Placement Assured Program

- 550+ Hiring Partners

- 100% Money Return Policy

- 100% assured internships

- Placement Assured Program

- 550+ Hiring Partners

- 100% Money Return Policy